What if Amazon and Cargill had a business model baby?

Published: March 8, 2019

Given Amazon’s recent grocery expansion news and the 2017 acquisition of Whole Foods, forward thinkers should consider how traditional business models might be outdated. What does the optimal business model or meat supply chain look like in the Amazon era?

More importantly, who will pioneer a new business model?

Let’s imagine a scenario where Amazon teams up with a packer in a big way.

Amazon brings the following core competencies to the table:

- Expansive customer base of loyal, consistent customers

- Unparalleled warehouse and distribution innovation

- A playbook to dominate new segments

- A data based approach to supply chain and customer facing innovation

While the packer brings the additional core competencies to the table:

- Processing capability

- Product innovation

- Quality control

- Food safety expertise

- Market knowledge

The old school, fragmented supply chain model insists that he who has the most information and the most slaughter capacity or customers “wins” and the supply chain is treated as a zero sum game.

The new way realizes the path to increased profitability and long term viability in a tectonically changing market means identifying the right partners then using data as the means to drive profitability across a shortened supply chain.

Shared data is the single mechanism that enables an integrated supply chain and business model alignment.

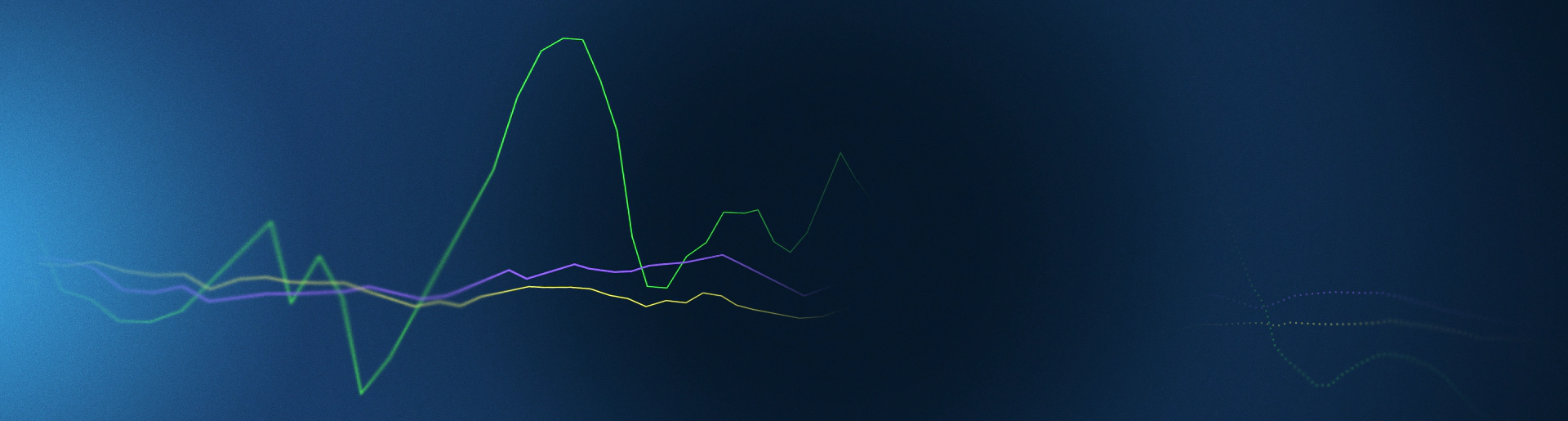

Imagine that as increasingly sophisticated analytics drive costs out of the supply chain for packer and retailer, several results emerge:

- Consumer demand for meat increases as the price goes down. Using their Amazon Prime membership, the consumer stops buying meat at Walmart or Kroger unless they’re in a bind and need last minute meat for supper - now its all Amazon all the time because of that perfect combination of better service and better prices.

- Amazon increases market share in meat, quickly outpacing traditional retailers through rapid category growth fueled by supply chain alignment, optimized product offering, and dynamic pricing.

- The packer increases market share as Amazon grows. Although the packer realizes a lower sales price per pound, as a result of removing the volume risk that packers inherently assume by dealing with retailers and reducing distribution costs, the packer’s margin per pound actually increases. Consumers begin to associate the packer’s brand with Amazon, innovation, and the future carving out mind space and increased brand loyalty that begets a cycle that would have Tyson marketers foaming at the mouth.

- I’d suggest that by better marketing the whole universe of cuts to the whole universe of consumers, there’s a very real opportunity to increase the total revenue stream available from the carcass. Today the carcass is marketed based on historical practices: It’s week 37 so we are going to run a chuck roast feature because that’s what we’ve always done. And oh by the way our competitors are probably going to do the same thing because collectively we have conditioned our response over the years. But moving to an optimized model where features are determined based on a host of forward looking factors could increase the total revenue stream available.

- There is an enhanced opportunity to better educate consumers around using different cuts of meat complete with recipes, ingredient ordering capabilities, etc., and all that based on preference and suggestion; just like Amazon does with books or any other category. You’ve ordered chuck roast before along with bell peppers and onions so maybe you’d buy a round roast alongside mushrooms and garlic. You see how this plays out, don’t you?

This isn’t the Star Trek version of the meat industry or a laughable fantasy about the future of food. This kind of partnership — or acquisitions that enable a look alike partnership — could emerge any moment.

Will food retailers and packers get in front of the curve and beat Amazon to the punch by building on existing relationships to break down traditional bottlenecks and leverage data analytics to pre-emptively transform the supply chain?

Curious how Amazon’s acquisition of Whole Foods could impact the entire meat supply chain? Download this white paper for insights about how Amazon dominates new segments & ways to prepare.

This article was originally published on Meatingplace.